Why Lattice

For the first time ever, our proprietary technology naturally resolves the Industry's classic billion-dollar puzzles, such as

- How to remove 'unintentional noises' while maintaining 'intentional bets'?

- How to reconcile 'alpha factors' with 'risk factors'?

- How to add 'alpha' to an existing strategy without overlap?

- How to differentiate 'skill' from 'luck'? and more...

due to precision and transparency breakthroughs, just as nanotechnology does to healthcare. Wondering how?

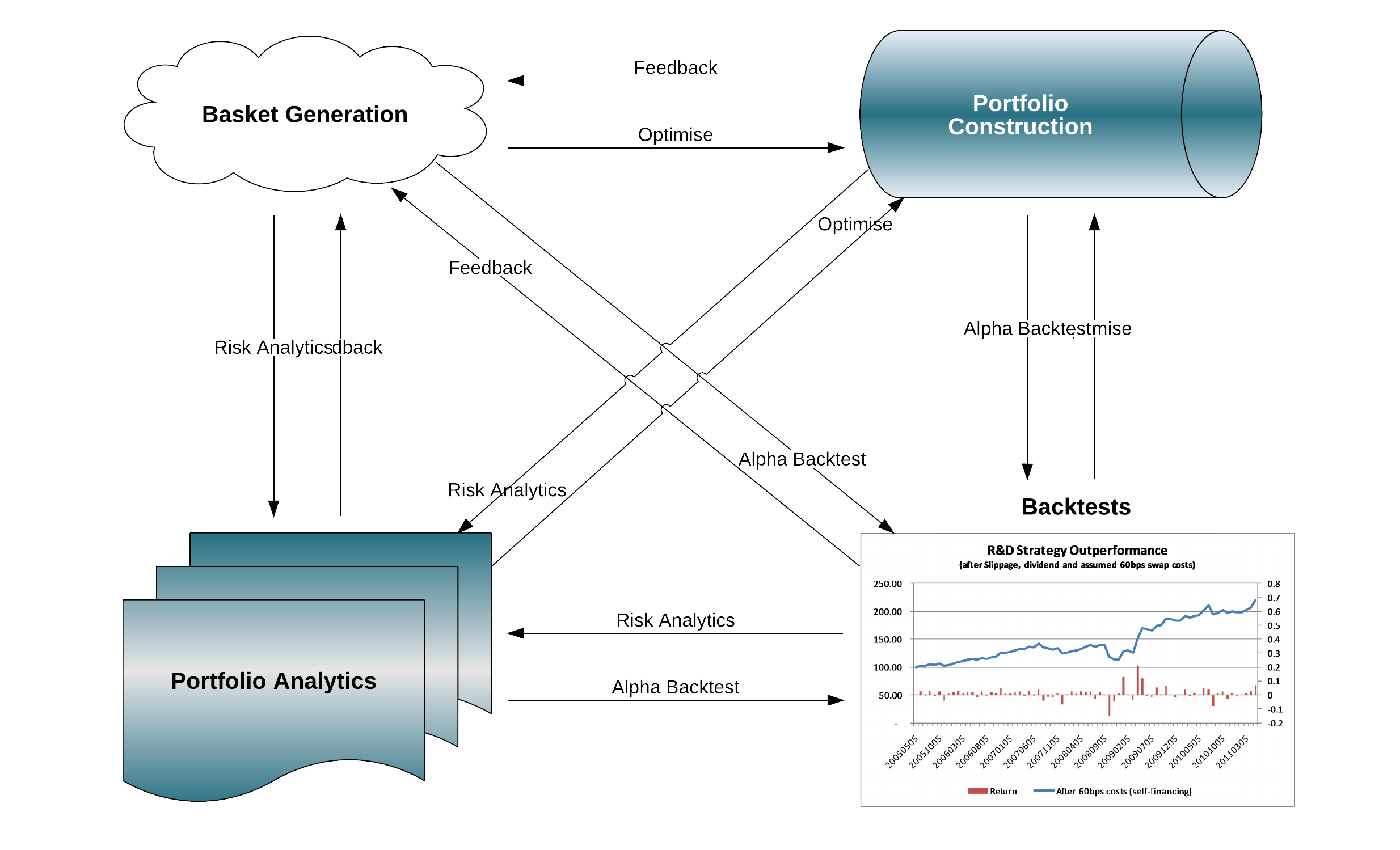

Practitioners design portfolio management processes suitable for their purposes. However diversified they are, professional portfolio construction processes typically involve 4 critical tasks:

Basket Generation

screening from a universe for stocks that fits target exposure and budget.

Portfolio Construction

allocating capital between stocks to achieve certain return-risk profile.

Portfolio Analytics

examining the return-risk profile of a portfolio.

Backtests

simulating a strategy in historical environment to see how it could have ‘performed’ (in terms of return, risk, stability etc.)

THEORETICAL AND PRACTICAL ELEGANCE

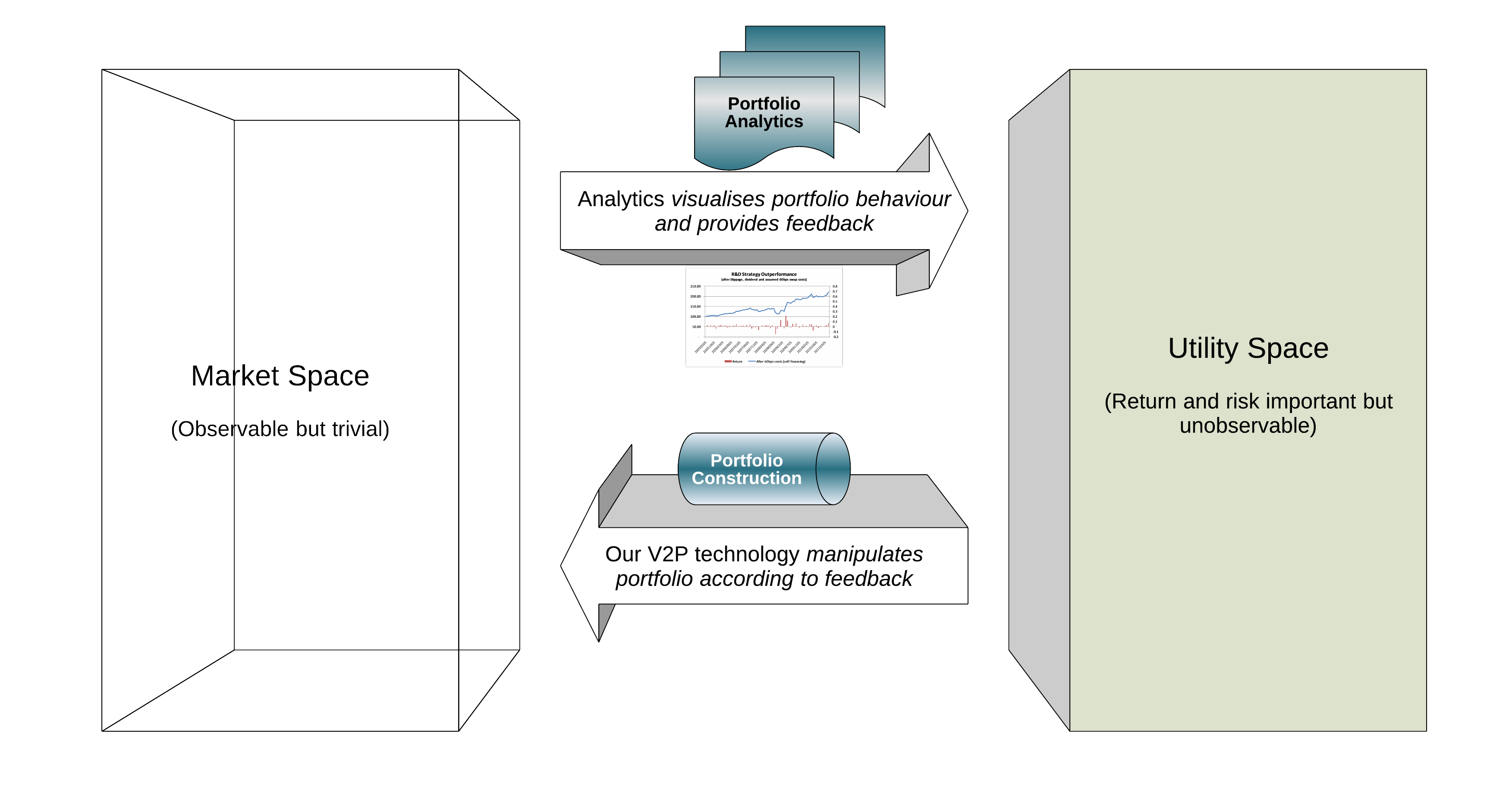

Lattice rightly facilitates the above tasks with 4 corresponding modules: Basket Generation, Portfolio Construction, Portfolio Analytics and Backtesting. Each module embraces our state-of-the-art IPs and intuitive interface design, ensuring precision, transparency and a pleasant user experience. By harmonizing the 4 separate modules in a single integrated framework, Lattice EPD platform potentially adds value to all possible alpha-generation, risk-management and trading processes.